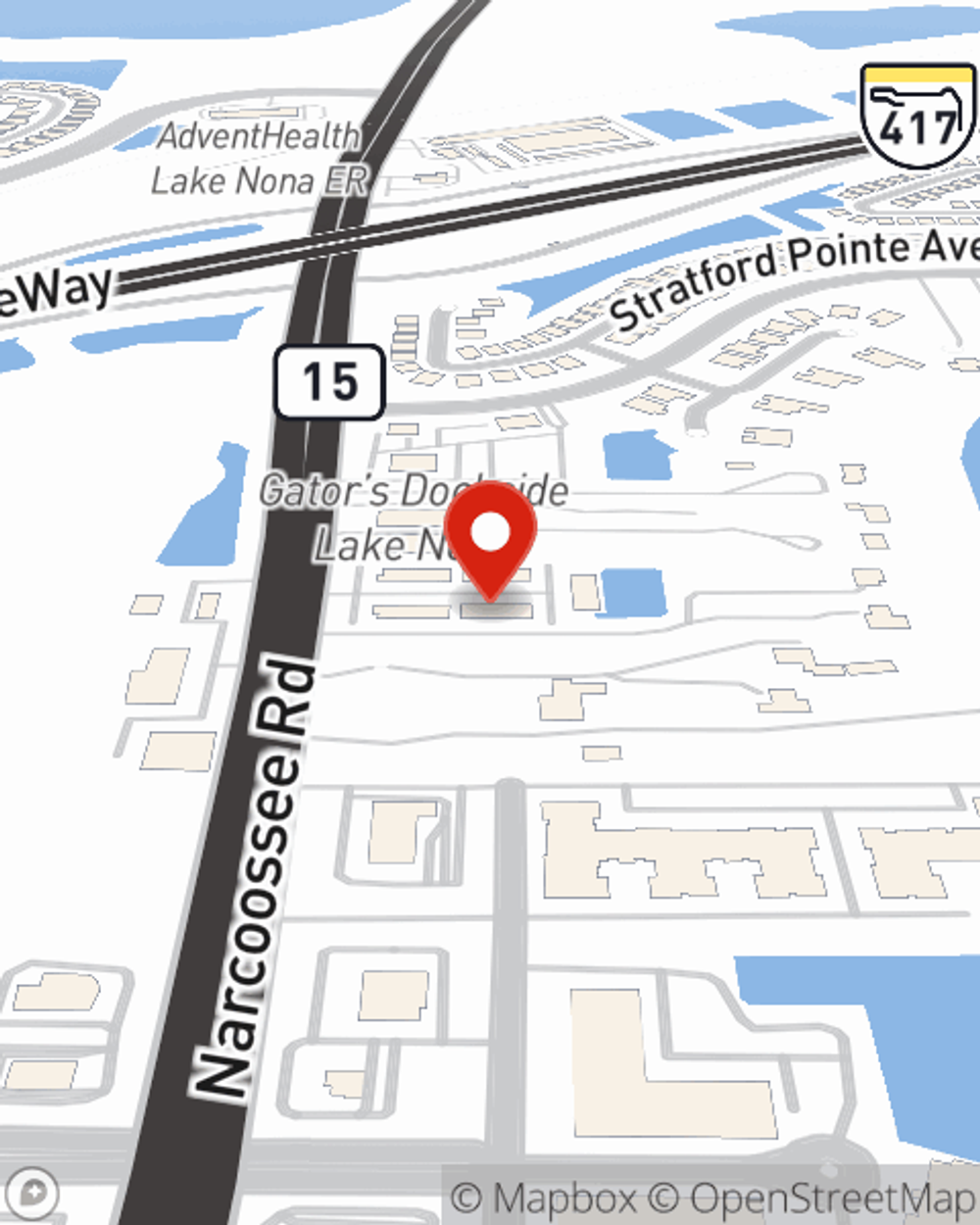

Homeowners Insurance in and around Lake Nona

Homeowners of Lake Nona, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Lake Nona

- Orlando

- Alafaya

- Avalon Park

- Northlake Park

- Laureate Park

- Eagle Creek

- Country Club

- Moss Park

What's More Important Than A Secure Home?

There's truly no place like home. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, an industry leader in homeowners insurance. State Farm Agent Manny Acosta is your reliable authority who can offer an insurance policy adjusted to fit your individual needs.

Homeowners of Lake Nona, State Farm has you covered

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Open The Door To The Right Homeowners Insurance For You

From your home to your treasured collectibles, State Farm is here to make sure your valuables are covered. Manny Acosta would love to help you know what insurance fits your needs.

It's always the right move to cover your home with State Farm. Then, you won't have to worry about the unanticipated fire damage to your property. Contact Manny Acosta today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Manny at (407) 601-3650 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Manny Acosta

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.